R&D TAX CREDITS FOR ARCHITECTS

But we're architects, we're not completing any Research & Development so can't make a claim.

WRONG.

If you're working on projects that involve overcoming technical uncertainties ahead of the build phase, your work may qualify.

Think of it like this.

If what your proposing isn't per the manufacturers guidelines and requires new methods, there may to scope to make a claim for R&D tax credits.

“Complete have proactively offered recommendations and answered all and any questions quickly and professionally and are always happy to chat things through over the phone.”

~ Shaun Olver, Full-stack Developer

So. What does Research & Development actually mean?

Well, it can be found in any industry - it’s not just reserved for science and tech businesses - you just need to know what you are looking for, so it’s important not to rule yourself out. We've made claims for businesses in Construction, Wholesale and Professional Services.

Great. But how do I know if I'm eligible?

You must be making improvements to products, processes or services.

The development helps to overcome technical challenges.

What should we be thinking about?

Are you designing bespoke features?

Are you developing process or designs to make them more efficient?

Do you develop prefabricated, modular or off-site manufactured designs?

Do your designs have to meet specific acoustic, thermal or lighting requirements?

Are you working to integrate plant & technology into your designs?

THINK YOU HAVE A CLAIM?

Let's talk!

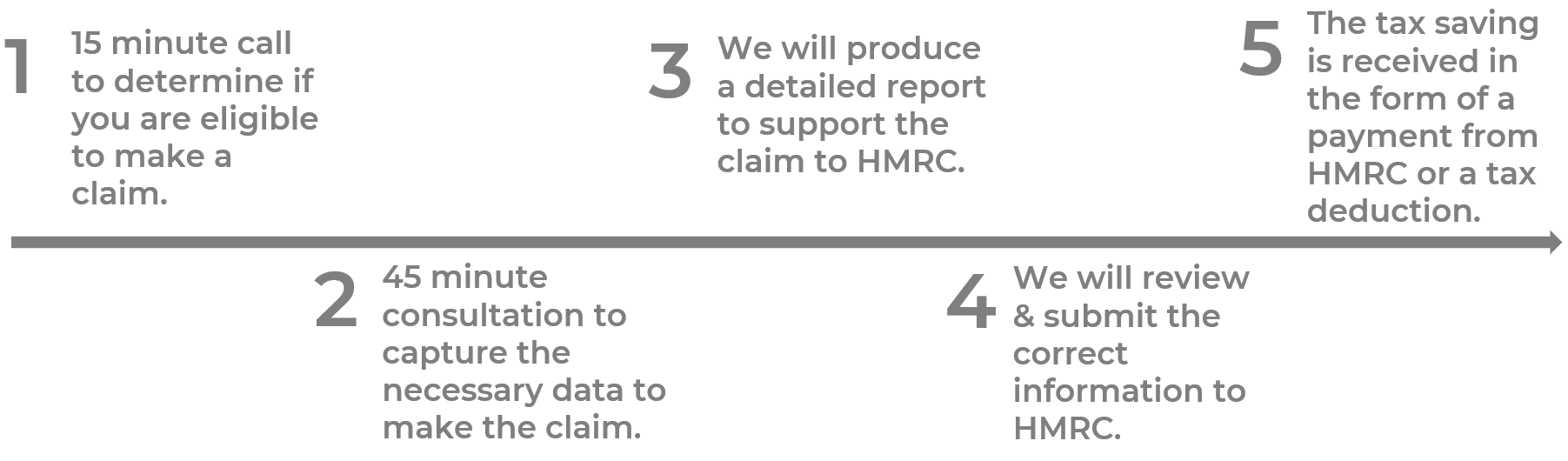

The process is straightforward and online requires 1 hour of your time. Worst case, you invest 15 minutes and rule out a claim. What do you have to lose?!?

We'd love to hear from you.

Given the value this could bring to your business, book a qualification call with our specialist to rule in or out a claim.