R&D TAX CREDITS

There are hundreds of tax reliefs available to UK businesses. But let's be honest, the most under utilised of them all is R&D Tax Credits.

R&D tax relief was introduced by the government to support and incentivise innovation amongst small and medium sized UK businesses. You could be claiming back up to £33 of every £100 spent, where the expenditure qualifies as Research & Development.

Sounds good, right?

“Complete have proactively offered recommendations and answered all and any questions quickly and professionally and are always happy to chat things through over the phone.”

~ Shaun Olver, Full-stack Developer

So. What does Research & Development actually mean?

Well, it can be found in any industry - it’s not just reserved for science and tech businesses - you just need to know what you are looking for, so it’s important not to rule yourself out. We've made claims for businesses in Construction, Wholesale and Professional Services.

Great. But how do I know if I'm eligible?

You must be making improvements to products, processes or services.

The development helps to overcome business challenges.

THINK YOU HAVE A CLAIM?

Let's talk!

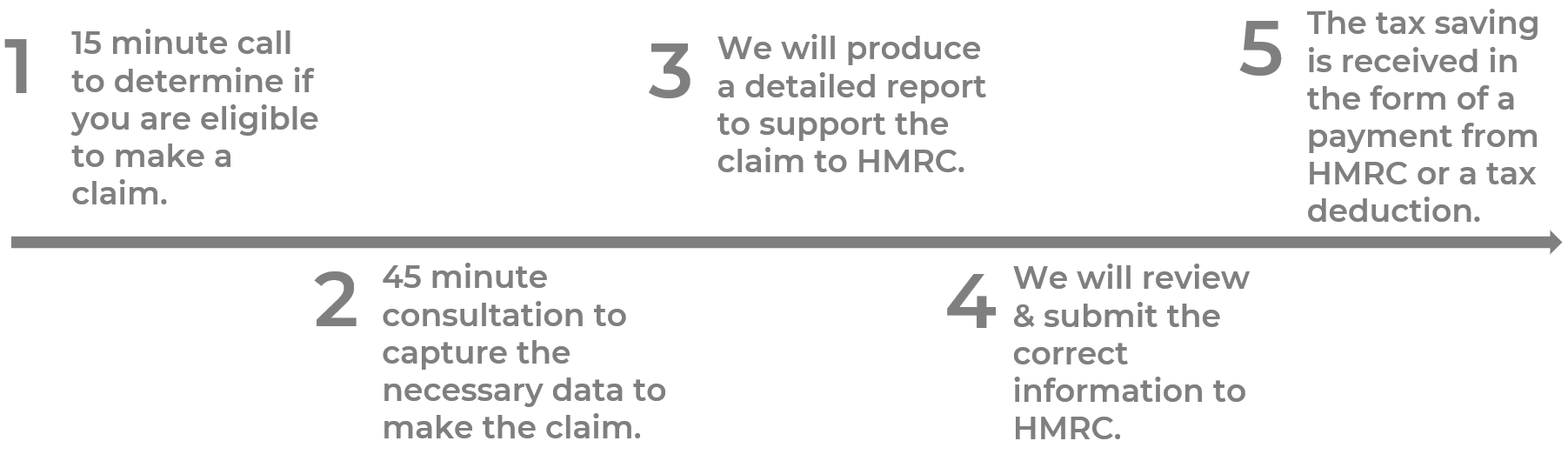

The process is straightforward and online requires 1 hour of your time. Worst case, you invest 15 minutes and rule out a claim. What do you have to lose?!?

We'd love to hear from you.

Given the value this could bring to your business, book a qualification call with our specialist to rule in or out a claim.